Previous Page

${prev-page}

Next Page

${next-page}

Elements of Compensation for Potential Negotiation

Elements of Compensation for Potential Negotiation

B. DEFINING RVUs 2

Many ID physicians’ compensation methodology is based partly on wRVUs generated from fee-for-service clinical activities. Therefore, a baseline understanding of the definition and how these are determined is important.

The Medicare resource-based relative value scale is the method by which Medicare sets reimbursement rates for each CPT code assigned to every physician encounter; thus, physicians’ services are counted in RVUs. Annually, RVUs are reviewed, adjusted for changes in technology and physician practice patterns, and published. Most organizations will either apply the changes the year they occur or will wait a year to roll out the changes. Medicare bases RVU on the following:

• Physician Work (wRVU): The physician’s expertise and the time and technical skill spent performing the entire service, considering the mental effort and judgment expended by the physician prior to, during and after the patient encounter terminates, including documentation of the service;

• Practice Expense (PERVU): The cost to operate a medical practice;

• Professional Liability/Malpractice (MPRVU): An insurance expense, which estimates the relative risk of services and cost to insure against the risk of loss in providing the service.

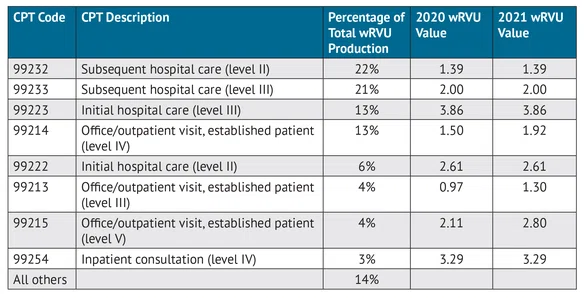

Each component of RVU is assigned to each CPT code that is recognized by insurance companies. The Medicare conversion factor is a national value that converts the total RVUs into the dollar amounts paid by Medicare to physicians for the services they provide and is updated annually. Nearly all commercial payers have also adopted RVUs to set their payment rates. It is important to note that Medicaid reimbursement rates for physician services vary by state and are generally lower than for Medicare, which is managed federally. To understand Medicaid reimbursements by state, please visit the “Medicaid-to-Medicare Fee Index.” All organizations use physicians’ wRVUs regardless of patient population age or the payer. Table 1 details eight CPT codes utilized by ID physicians that account for approximately 86% of all wRVU production.

Importantly, CMS periodically alters both wRVU value associated with each CPT code and the rate by which wRVUs are compensated by Medicare (the conversion factor). Generally, commercial health care insurance companies and state Medicaid programs also adopt the same wRVU values as Medicare. The most recent changes in 2021 increased wRVU values associated with outpatient E&M codes, while inpatient codes either stayed the same or decreased slightly. CMS also decreased the conversion factor. In aggregate, the increased wRVU value for some CPT codes and decreased conversion factor for all CPT codes is intended to be reimbursement neutral. However, the impact to any given specialty depends on a physician’s relative mix of CPT codes. ID physicians should be aware of these changes as they enter new compensation or service contract negotiations with hospitals and health systems.

TABLE 1: Example ID CPT and wRVU Values 3

2. aapc.com/practice-management/rvus.aspx.

3. Data are sourced from the ECG “2020 Physician and APP Compensation Survey” and “2021 Physician Compensation Survey” and are based on the top CPT codes for ID physicians.